How to submit an online income tax return

How to file Bangladesh taxes online

This Tax Year (2023–2024), similar to the last few, you can electronically file your income tax return from home. This is a step-by-step tutorial on online tax filing.

This Tax Year (2023–2024), as in the previous several, you can electronically file your income tax return from home. This is a step-by-step tutorial on using the online tax filing system.

Who bears the tax burden?

The tax season in Bangladesh runs from July 1 to November 30. It is during this period that you must file your taxes. Make sure you review the tax guidelines available on the National Board of Revenue’s (NBR) official website for the most recent fiscal year.

According to NBR, if your income surpasses a specific level, you have to file an income tax return. The standard cap is BDT 3,50,000, whereas BDT 4,000,00 is the cap for women and senior citizens over 65. The tax-free income level for gazette liberation fighters injured in combat is BDT 5,00,000.

Further requirements for submitting taxes include living in an urban area, owning a car, having certain professional associations, operating a business, filing taxes in the past, and taking part in elections or tenders. This also holds true for NGOs and registered businesses.

Additionally, keep in mind that if you possess a 12-digit taxpayer identity number (TIN) certificate, you are required by law to file your tax return annually (you can file zero for non-taxable income). Failing to do so could result in fines and penalties.

Documents needed

Provide all necessary documentation for filing taxes, including the prior year’s return, an eTIN, and a copy of your NID. Salary certificates, bank statements, and other pertinent paperwork are required for employees. Provide the necessary certifications or documentation for each source of income. Add information about properties, investments, and tax-free income certificates. Fulfilling these prerequisites guarantees adherence to tax duties.

A detailed how-to for electronically filing your taxes

i) Obtaining a certificate of TIN

Every year, citizens of Bangladesh who have been granted a Taxpayer Identification Number (TIN) are required to file an income tax return. Firstly, any adult over the age of eighteen is required to obtain a TIN. You will be assigned a specific zone or region for tax purposes when you apply for a TIN. It is your duty to notify the government of your income once you have obtained all required paperwork. Send your tax return, in person or by a representative, to the appropriate regional or zonal tax office.

ii). Signing up for the electronic return system

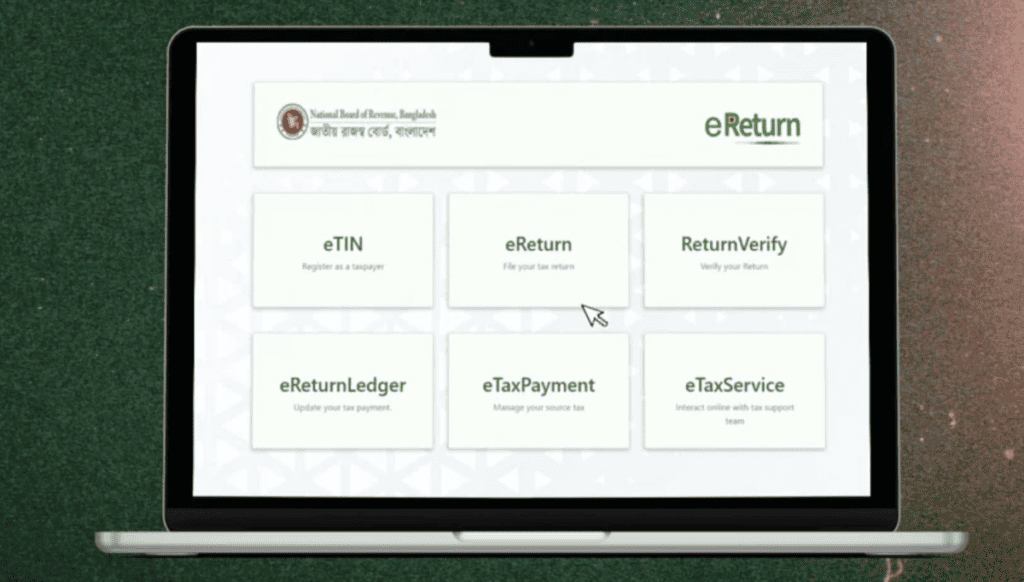

You must register or sign up for the e-return system using your TIN and a cellphone number that is registered in your name in order to submit an e-return online. The procedure for registering in the e-return system is as follows. Go to NBR’s official website and sign up for the electronic return system.

Fill out the first box with your TIN. Next, input your national identity card’s biometrically registered cellphone number (without the first zero). After accurately entering the captcha code, click the “Verify” button. In order to log into the e-return system going forward, confirm your phone number with the given OTP and create a password.

Step 1: Log in to the e-return system.

Go to the NBR official website and select ‘eReturn’, the second option from the left. Additionally, you can go to www.etaxnbr.gov.bd, the online income tax return filing system. Next, enter your TIN, password, and captcha before selecting “Sign in.” You will be presented with a dashboard after logging into the portal. Select the ‘Return submission’ option located on the left side.

Step 2: Details of the tax assessment

You will see ‘Tax Assessment Information’ at the start of the e-return form. This is where you will find information on income tax, including return scheme, year of income, and source information that you need to supply. Additionally, enter the relevant amount and resident status in the box if your income is tax-exempt.

Step 3: Details of income

Choose your different revenue streams from the Heads of Income during this step. Salaries, interest on securities, income from real estate, income from agriculture, income from a business or profession, income from capital gains, and income from other sources are all included under the heading of income.

For instance, choose ‘Salary’ if your pay is your only source of income. Choose ‘Income from other sources’ and choose the source from the dropdown menu if you get money from sources other than your salary.

Next, select ‘Save and continue’ to move on to the next step.

Step Four: Further details

Using a dropdown box that includes Dhaka North City Corporation, Dhaka South City Corporation, Chittagong City Corporation, Other City Corporation, and Any Other Area, you will select the location of your main source of income in this phase.

You can also specify if you’re a disabled person, a war-wounded gazette freedom fighter, or if you’re requesting benefits on behalf of a parent or legal guardian of a disabled person. Additionally, you will indicate in this part with a “Yes” or “No” whether you are a shareholder director of a company and if you are eligible for tax rebates because of investments.

Step 5: IT10B specifications

You must complete the statement form’s expenditure section if your total assets exceed BDT 40 lakh. The ‘IT10B form’ needs to be completed for this. You can skip IT10B if your entire assets are less than BDT 40 lakh. In this scenario, you have to include all of your yearly family and personal spending.

Next, select ‘Save and continue’ to move on to the next step.

Step 6: Details of income

Provide information about your overseas income, tax-exempt income, and other sources of income. The dropdown menu contains a number of alternatives that you can use when reporting income from sources other than salaries or taxable investments.

If you select “any other income,” for example, you will be required to supply information on the source of income, the authority making the payment, the date of your most recent income receipt, the amount of income, and any related costs. Your net income will then be computed based on this data and automatically shown on the screen.

Next, select ‘Save and continue’ to move on to the next step.

Step 7: Type of Investment

Choose one of the investment categories you are currently involved in, such as life insurance premiums, deposit premium services (DPS), approved saving certificates, general provident funds, benevolent funds, and group insurance premiums; alternatively, go with another option.

For example, if you choose the DPS option, you will be required to provide the name, account number, and deposit amount of the bank. You will then be able to view the total amount of your authorized investment for the rebate.

Next, select “Save and Continue” to move on to the next step.

Step 8: Investing

You can see how much you’ve spent compared to your total revenue in this section. There will be categories where you may enter the amounts and add notes for different expenses. Food, clothing, housing (including auto, transportation, home, and utilities), children’s education, and any other expenses are all included in these areas. The system will determine how much tax you owe after you enter these facts.

Step 9: Payment and taxes

Any source tax and advance tax that you have previously paid can be shown here. Source tax and advance tax will automatically lower the total amount owed. If you owe no tax on your income, the Payable Amount is $0. A return with a zero “Payable Tax Amount” is referred to as a “zero return.”

10: Go back to the view

Selecting ‘Online Return’ enables you to electronically file your tax return. A sample of the return form will appear. Just check the box next to Verification and Signature at the bottom of the form to indicate that you agree. You cannot edit your return once you click the “Yes” button. Your return will be mailed. You can click ‘No’ to examine the form if you are unsure about the information. Select the ‘Yes’ option to submit after everything appears to be in order.

Step 11: Download the receipt acknowledgment.

The following message will appear if the income tax return is successfully filed: “Congratulations! The submission of your return was successful. The Reference ID and Acknowledgment Receipt of the return submission can be downloaded from this page.

At this point, your income tax return is complete. You can now print a copy of the form and mail it directly to the income tax department, or you can file your return electronically. You may easily file your income tax return electronically with the help of our comprehensive instructions.

You might also think about seeking guidance from an expert, such as a top tax law firm in Bangladesh, if you find this process to be very complicated.

0 Comments