Setting Up a Factory in Bangladesh: A Comprehensive Guide

Setting up a factory in Bangladesh offers numerous opportunities, given the country’s favorable economic environment and strategic location. You will find a comprehensive article on here on (Setting up a factory in Bangladesh) this website by TRW law firm. But, below is a step-by-step precise guide to help you navigate the process efficiently.

1. Company Registration

The first step in setting up a factory is registering your company with the Registrar of Joint Stock Companies and Firms (RJSC). This involves several sub-steps:

- Name Clearance: Obtain name clearance from the RJSC.

- Drafting Documents: Prepare the Memorandum of Association (MoA) and Articles of Association (AoA).

- Submission and Payment: Submit the required documents and pay the necessary fees.

Typically, a private limited company requires at least two shareholders and two directors, and it is advisable to have a minimum authorized capital of USD 50,000 for legal and operational flexibility (Tahmidur Rahman Law Firm in Bangladesh).

2. Acquiring Necessary Licenses and Permits

Post-registration, you need to secure several licenses and permits:

- Trade License: Obtain this from the local City Corporation or Municipal Office.

- Tax Identification Number (TIN): This is mandatory for all businesses.

- VAT Registration: Essential for taxation purposes.

- Fire License and Environmental Clearance: These are critical, especially for manufacturing units.

- Factory License: Required under the Factories Act 1965.

Depending on the nature of your business, additional licenses such as an Import Registration Certificate (IRC) and Export Registration Certificate (ERC) might be necessary (Tahmidur Rahman Law Firm in Bangladesh) (Tahmidur Rahman Law Firm in Bangladesh).

3. Selecting a Location

Choose a suitable location for your factory. Consider factors like proximity to raw materials, availability of labor, and infrastructure. You may also explore options in special economic zones (SEZs) which offer tax benefits and other incentives.

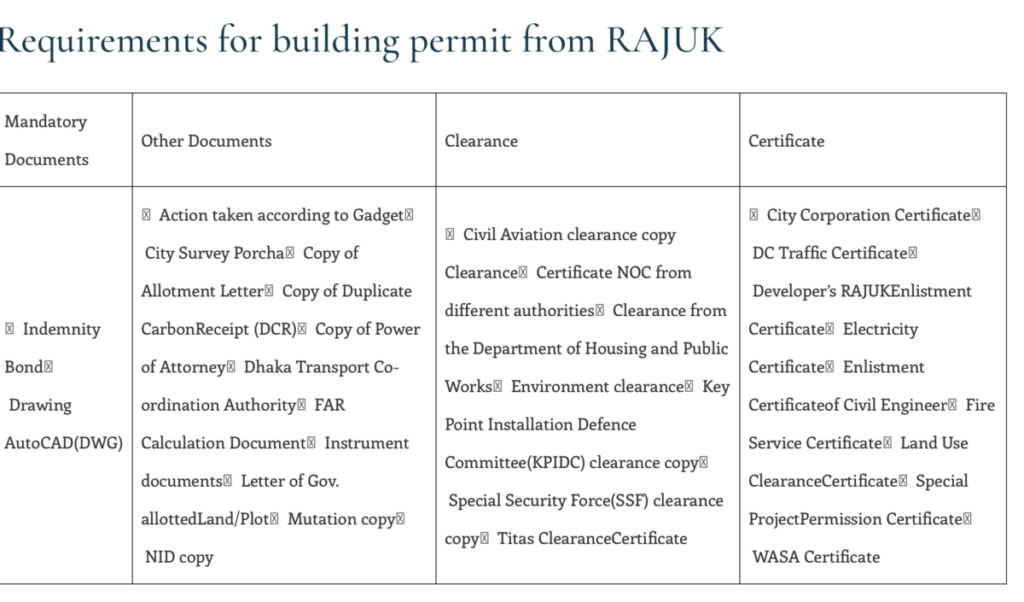

4. Construction and Utilities

Engage with local authorities to ensure that your construction complies with all regulations. Secure connections for essential utilities such as electricity, water, and gas.

5. Importing Machinery and Equipment

For importing machinery, you will need an IRC. Coordinate with suppliers, freight forwarders, and customs brokers to handle logistics efficiently. Ensure all machinery complies with local standards and regulations (Tahmidur Rahman Law Firm in Bangladesh) (Tahmidur Rahman Law Firm in Bangladesh).

6. Hiring Employees

Comply with the Bangladesh Labour Act 2006 regarding hiring practices, wages, working hours, and safety standards. Consider engaging a local HR consultant to help navigate local labor laws.

7. Compliance and Quality Control

Ensure your factory meets all regulatory compliance requirements. Regularly liaise with bodies like the Bangladesh Standards and Testing Institution (BSTI) to maintain product quality and standards (Tahmidur Rahman Law Firm in Bangladesh).

8. Managing Finances and Banking

Open a corporate bank account and manage your finances efficiently. Bangladesh offers various financing options through local and international banks, with competitive interest rates for trade finance, term loans, and working capital (Tahmidur Rahman Law Firm in Bangladesh).

9. Taxation and Legal Compliance

Regularly file taxes and ensure compliance with all legal requirements. It is advisable to engage a local legal expert to handle ongoing compliance issues and to navigate the complexities of local business laws.

10. Continuous Improvement and Expansion

Once your factory is operational, continuously monitor and improve your processes. Explore opportunities for expansion within Bangladesh or into other markets.

Setting up a factory in Bangladesh involves navigating several regulatory and procedural steps. Engaging with a reputable legal firm, such as Tahmidur Rahman Remura Wahid, can streamline the process and ensure compliance with all local regulations (Tahmidur Rahman Law Firm in Bangladesh). For detailed guidance and professional assistance, visit Tahmidur Rahman Remura Wahid’s website.

By following these steps, you can successfully establish and operate a factory in Bangladesh, leveraging the country’s strategic advantages and growing economic landscape.

Licensing Requirements in Details:

Setting up a factory in Bangladesh is a lucrative endeavor due to its strategic location, abundant workforce, and favorable economic policies. This guide provides an in-depth overview of the necessary steps and legal requirements, with insights from Barrister Tahmidur Rahman’s expertise.

Initial Steps and Company Registration

- Business Structure: Decide on the business structure, such as a sole proprietorship, partnership, or private limited company. Most foreign investors opt for private limited companies due to limited liability and ease of operations.

- Name Clearance and Incorporation: Obtain name clearance from the Registrar of Joint Stock Companies and Firms (RJSC). Following this, draft the Memorandum of Association (MoA) and Articles of Association (AoA), and file these documents along with the necessary forms to incorporate the company.

- Trade License: Secure a trade license from the local city corporation or municipality. This involves submitting passport copies, application forms, photos, and tenancy agreements for verification (Resource Portal | OGR Legal)).

Licensing Requirements

Setting up a factory involves several specific licenses and approvals:

- Factory Registration Certificate: Apply to the Department of Inspection for Factories and Establishments (DIFE). Required documents include construction designs, a trade license copy, filled forms (Form 1 and Form 2), MoA for limited companies, and payment receipts of license fees (BusinessConsultBD).

- Tax Identification Number (TIN): Obtain from the National Board of Revenue (NBR) by applying online and submitting a physical passport copy for verification (S & F CONSULTING FIRM LIMITED).

- VAT Registration: Also acquired from the NBR, this requires a bank solvency certificate, application form, tenancy agreement, and company registration documents

- Environmental Clearance Certificate (ECC): Issued by the Department of Environment (DOE), this is crucial for complying with environmental regulations. Submit an environmental impact assessment report and obtain site clearance before applying for the ECC

- Fire License: Essential for safety compliance, this is obtained from the Fire Service and Civil Defense. Submit land or building plans, company registration documents, VAT and tax licenses, and proof of purchase for fire safety equipment

- Import and Export Registration Certificates (IRC and ERC): Required for trading activities, these are issued by the Office of the Chief Controller of Imports & Exports (CCI&E). Necessary documents include company registration certificates, trade licenses, tax and VAT certificates, and chamber of commerce membership

- Approval of Factory Plan: Submit the factory layout for approval to the DIFE. This step ensures the factory layout meets safety and operational standards

Legal and Regulatory Compliance

- Land Acquisition: Conduct thorough due diligence to verify land ownership and ensure proper transfer of title. This involves executing and registering the sale deed and updating land records (mutation)

- Banking and Foreign Exchange Regulations: Adhere to regulations set by Bangladesh Bank for foreign transactions, including opening Letters of Credit (LC) for importing materials and ensuring secure foreign currency inflows from exports

- Labor Laws Compliance: Comply with Bangladesh labor laws regarding worker safety, wages, termination, and benefits. The DIFE oversees these regulations, ensuring worker welfare and factory compliance

Setting up a factory in Bangladesh involves navigating a complex landscape of regulatory requirements and licenses. By following this guide and consulting with legal experts like Barrister Tahmidur Rahman, investors can ensure compliance and smooth operations. With the right preparation, establishing a factory in Bangladesh can be a rewarding venture, tapping into the country’s economic growth and industrial potential.

0 Comments