Disputes and transactions on the Capital Market Transactions are an essential element of the financial environment in Bangladesh. These markets facilitate investment activities, capital formation, and economic expansion.

Nevertheless, similar to any other financial ecosystem, they are replete with intricacies and obstacles. This exhaustive guide aims to provide an in-depth analysis of capital market transactions, the legal framework governing them, and the resolution of disputes in the dynamic financial markets of Bangladesh.

A Comprehension of the Capital Markets in Bangladesh

Capital markets are platforms where governments, corporations, and individuals raise capital through the issuance and trading of a variety of financial instruments. These instruments consist of, among others, debt securities (bonds and debentures), equities (stocks), and mutual funds in Bangladesh.

On the capital market of Bangladesh, there are a number of significant participants, including:

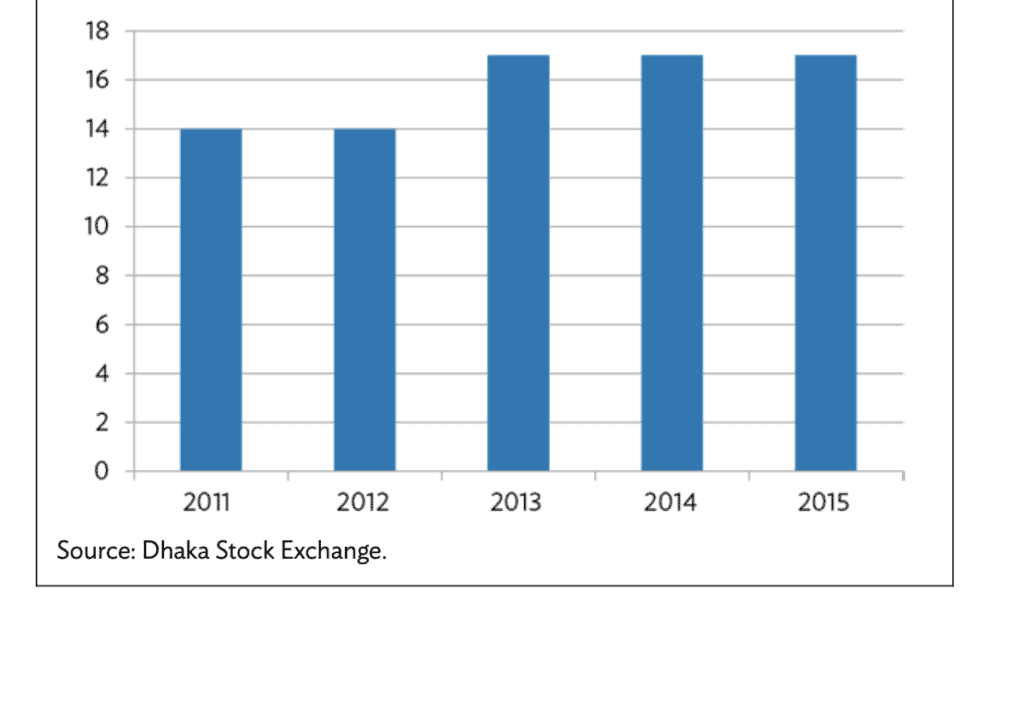

The Bangladesh Securities and Exchange Commission (SEC) serves as the principal regulatory body responsible for supervising activities within the capital market.The principal stock exchanges in Bangladesh are the Chittagong Stock Exchange (CSE) and the Dhaka Stock Exchange (DSE).

Listed companies are those that have completed the process of going public and have their securities listed on stock exchanges for trading.

Investors: Institutional and individual investors who engage in market activity through the purchase and sale of securities.

Intermediaries comprise asset management firms, brokerage firms, and additional financial institutions that serve to facilitate market activities.

The capital markets hold immense importance for a multitude of reasons:

Economic Growth: They furnish government agencies and enterprises with vital funding, thereby facilitating economic development.

Investor Opportunities: By allocating capital to a variety of financial instruments, investors can potentially increase the diversity of their portfolios and generate returns.

Listed companies are obligated to comply with regulatory disclosure requirements, which foster market transparency and ensure accountability.

Capital markets provide liquidity, which facilitates the purchase and sale of securities by investors.

A Legal Structure Governing Capital Market Transactions

In Bangladesh, capital market transactions are governed by a legal framework comprised of the following statutes, rules, and regulatory agencies:

The SEC is the Securities and Exchange Commission. The SEC is the primary regulatory body tasked with the oversight and regulation of activities on the securities market. It ensures adherence to securities laws, issues regulations, and develops policies.

The Companies Act of 1994 regulates a multitude of corporate law facets, including the conduct of listed companies, the issuance of securities, and corporate governance.

Listing Regulations: In order to be listed on the DSE or CSE, businesses are required to comply with the respective listing regulations of each exchange.

Stock Exchange Regulations: Trading, listing, and various operational facets of the DSE and CSE are governed by distinct sets of regulations.

Securities Laws: The legal framework for regulating securities transactions is established by securities-related legislation, including the Securities Act of 1920 and the Securities and Exchange Ordinance of 1969.

Investor Protection Regulations: To safeguard the interests of investors, the SEC has enacted a number of regulations, including disclosure requirements and insider trading regulations.

Transactions on the Capital Market in Bangladesh

The categorization of capital market transactions in Bangladesh comprises the subsequent types:

Initial Public Offerings (IPOs): In order to generate capital from the general public, corporations may opt to issue shares via an IPO. The initiation of the process to become a publicly traded corporation.

Trading on the Secondary Market: Investors are able to barter previously issued securities on the secondary market. This consists of the purchase and sale of stocks on stock exchanges.

Debt Market Transactions: The trading of bonds and debentures issued by private and public sector entities is open to investors.

Mutual fund investments consolidate capital from numerous investors in order to construct a diversified portfolio comprising equities and bonds.

Regulatory compliance necessitates that both corporations and investors conform to prescribed guidelines and obligations. This entails the regular reporting of financial results, adherence to listing regulations, and disclosure of financial information.

Disputes on the Capital Market and Resolution

In capital market transactions, disputes frequently emerge and necessitate resolution. Disputes between investors and brokerage firms, accusations of market manipulation, or securities fraud are frequent topics of contention. Multiple approaches are possible to the resolution of these disputes:

Conventional litigation entails the formal presentation of arguments by the involved parties before a judge and, in certain instances, a jury in a court of law. While litigation can be expensive and time-consuming, it offers the opportunity for judicial remedies through a formal legal procedure.

Arbitration is a confidential procedure in which the involved parties consent to have their disagreement reviewed by an arbitrator or a tribunal of arbitrators. In addition to being quicker and less expensive than litigation, arbitration grants the parties greater authority over the proceedings. Arbitration in securities is a prevalent method utilized to address conflicts that arise between brokers and investors.

A neutral mediator facilitates a process of non-binding, facilitated negotiation in which the parties attempt to reach a solution that is acceptable to all. Parties are not obligated to reach an agreement through mediation, which is non-binding and may foster greater cooperation rather than hostility.

Regulatory and Self-Regulatory Organizations: Self-regulatory organizations (SROs) and regulatory authorities oversee a significant number of capital market disputes. Frequently, these organizations have protocols in place to address conflicts, which may involve imposing disciplinary measures on participants in the market.

Financial ombudsman services have been instituted in certain nations with the intention of facilitating the resolution of disputes between consumers and financial service providers in a cost-effective and impartial manner.

Institutions for Alternative Dispute Resolution (ADR): Alternative Dispute Resolution (ADR) institutions offer specialized services to settle capital market disputes outside of the conventional court system. Frequently, these establishments provide an array of procedures, such as expert determination, arbitration, and mediation.

Difficulties Linked to Capital Market Transactions

The following are potential hazards that investors and market participants in Bangladesh should be cognizant of when engaging in capital market transactions:

Regulatory modifications have the potential to affect market dynamics and the desirability of specific investments. It is crucial to remain updated on regulatory developments.

Market Volatility: Investing decisions may be influenced by fluctuations and periods of volatility that occur on the capital market.

Liquidity Risk: Although the market as a whole operates in a predominantly liquid state, specific equities, bonds, or securities may experience periods of illiquidity.

Concerns Regarding Corporate Governance Certain businesses may have governance concerns that have an impact on their stock performance. Evaluating the governance practices of the companies in which one invests is of the utmost importance.

Economic Factors: The capital market’s performance is intricately linked to the nation’s overall economic state. Economic recessions have the potential to negatively impact the performance of markets.

Protection and Education of Investors

Protection and education of investors are of the utmost importance when it comes to capital market transactions. Bangladesh has implemented various initiatives aimed at enhancing investor knowledge, promoting transparency, and safeguarding their interests:

Investor education programs and campaigns are implemented by a multitude of organizations and regulatory bodies with the objective of enlightening investors regarding risk management, regulatory compliance, market dynamics, and risk mitigation.

Regulatory oversight is an ongoing process in which regulatory bodies, including the SEC, monitor the market to ensure adherence to securities laws and regulations. This safeguards the interests of investors.

Transparency and Disclosure: In order to furnish investors with an accurate understanding of their investments, publicly traded companies are obligated to disclose material events, financial information, and corporate governance practices.

To conclude

Disputes and transactions on the Capital Market Transactions are fundamental to the economic development and growth of Bangladesh. To successfully navigate the capital market, investors and market participants must have a comprehensive understanding of the legal framework, transaction types, and dispute resolution methods. Although the environment offers prospects, it is not devoid of obstacles; therefore, it is critical to remain updated on regulatory modifications and prospective hazards in order to formulate well-informed investment judgments. Investors can secure their own interests while contributing to the nation’s financial development in this dynamic financial ecosystem if they possess the appropriate information and resources.

0 Comments